The performance and return on investment (ROI) messaging offered by many companies entering the biologicals market is insufficient for most farmers, dealers, distributors, or their trusted advisors to consider adoption. One highly experienced due diligence reviewer of acquisition candidate products has shared what is needed to confirm commercial potential: “At least 30 or 40 trials per crop/market target per year, with a majority of positive responses, over a two-to three-year period would be a minimal package for many companies; others require a minimum of three years successful field tests to add a product to their commercial portfolio with predictability.”

Robust, Credible Data

The data must also be scientifically valid, representative of geographical areas in which the product will be used and deeply analyzed with summaries across years and locations. Analysis should also include ROI based on rates and on-farm pricing. In addition to traditional small plot field trials, many dealers, distributors and especially farmers, also want to see large-scale, on-farm, replicated trials using commercial equipment to provide confirmation of commercial viability. This should document not just how to use the product, but where and when for best results.

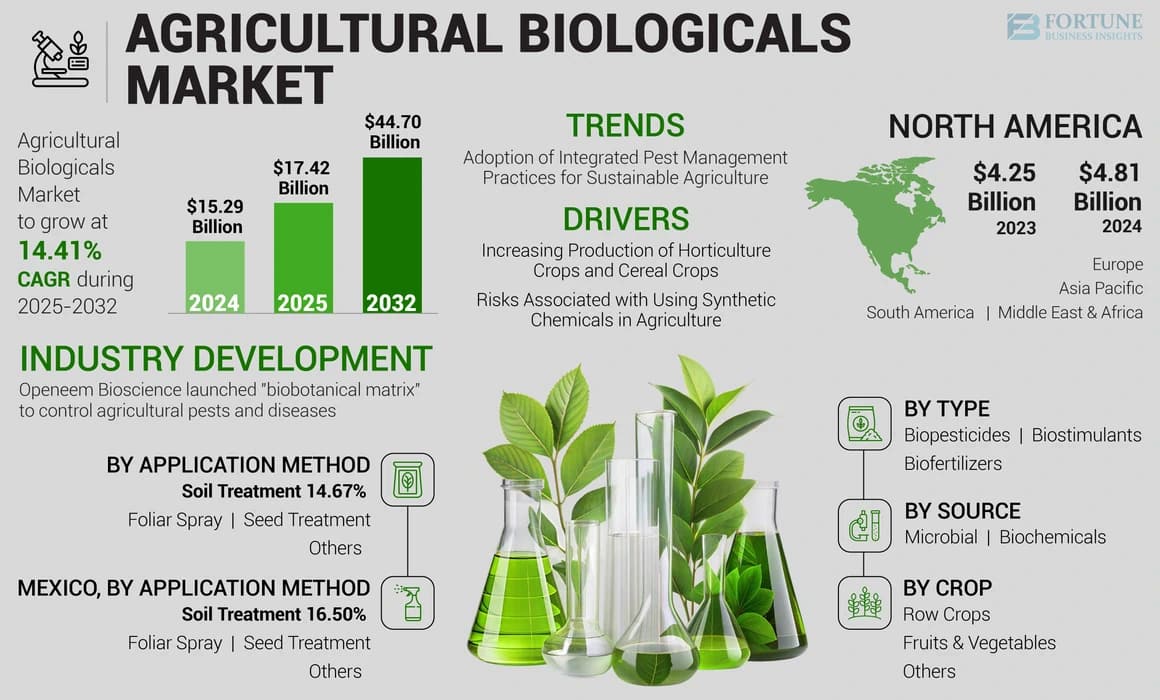

Farmers today are faced with an extensive and rapidly expanding selection of biological production inputs. As of August 14, 2025, US EPA databases indicate there are 446 biological products registered as active ingredients in pesticides. These biologicals are registered as active ingredients in 2,122 biochemical products and 615 microbial products.

Biologicals are available to control pests and weeds, enhance plant nutrition, and provide about any desirable outcome provided by chemical inputs. The primary benefits of biological products compared to conventional chemicals are well known and accepted by farmers, dealers, and distributors. These benefits include applicator safety, reduced environmental impact, improved soil health and pest resistance management.

Biopesticides aimed at controlling pests and diseases, accounted for the largest share of the agricultural biologicals market in 2024, according to Fortune Business Insights. This market analysis also reported North America with the dominant market share of 31.46% in 2024. This report predicted the US to reach USD 10.09 billion by 2032 while the global market prediction is 15.29 billion.

Biological Market Research Findings

Recent market research by the Stratovation Group, surveyed row crop farmers about their use of biological inputs. The survey was a follow-up to a similar study in 2022. Awareness of biologicals among row-crop farmers has increased from 83% to 87% since 2022. The number of farmers currently using biological products is up from 37% in 2022 to 45% in 2024. The 8% increase in adoption is impressive but still, over half of the row crop producers surveyed do not use biologicals.

Farmers using biologicals prioritized increased yield and profitability as the most important considerations in their decision to use biologicals. These characteristics were rated more important than improved soil health or reduced synthetic chemical or fertilizer use. Another study of specialty crop growers produced similar results. Improved crop quality, increased yield and better pest control were the most important considerations in using biologicals.

Takeaways for Biological Innovators

For companies developing new biologicals for agriculture, these responses provide insight into what would motivate non-users to adopt biologicals. Growers want scientific verification of performance that results in improved or comparable ROI. Other safety and environmental benefits of biologicals are a plus but only if the minimum standards of performance and ROI are proven.

A strong database includes both quantity and quality of data. All too often companies come into the market with impressive but limited data. At commercial roll-out of a new product, the major competitors in this market customarily have multiple seasons of data refined, enriched, and deeply analyzed for verification of performance.

CropLife’s 2024 Biologicals Survey found that nearly half of all respondents cited “a lack of trust in product performance” as the number one reason for lagging adoption rates, followed by cost. Since the first CropLife 2018 survey, respondents have reported a lack of trust in product performance as the biggest reason for lagging adoption rates.

The ultimate impact on any customer in the supply chain will be realized with a solid and extensive database submitted to intensive analytics to identify and quantify as many performance impacting variables as possible. Performance-impacting variables include soil, climate, and production practices. Understanding performance-impacting variables results in predictability of results and reinforces decision making. Ultimately farmers want to understand the Best Management Practices, what to expect, and how to evaluate performance. Adoption of biologicals depends on scientifically supported positioning with education and training of trusted advisors as well as the farmers themselves.

When preparing your novel products to compete in real-world environments, do not risk first-use failure. Engage the experienced StatWerx™ AgriThority® analytic team to build actionable insights for best management practices and to de-risk your go-to-market plans. This analytic program drives confidence, credibility, and ROI. Farmer testing and experience must start positively to improve adoption.

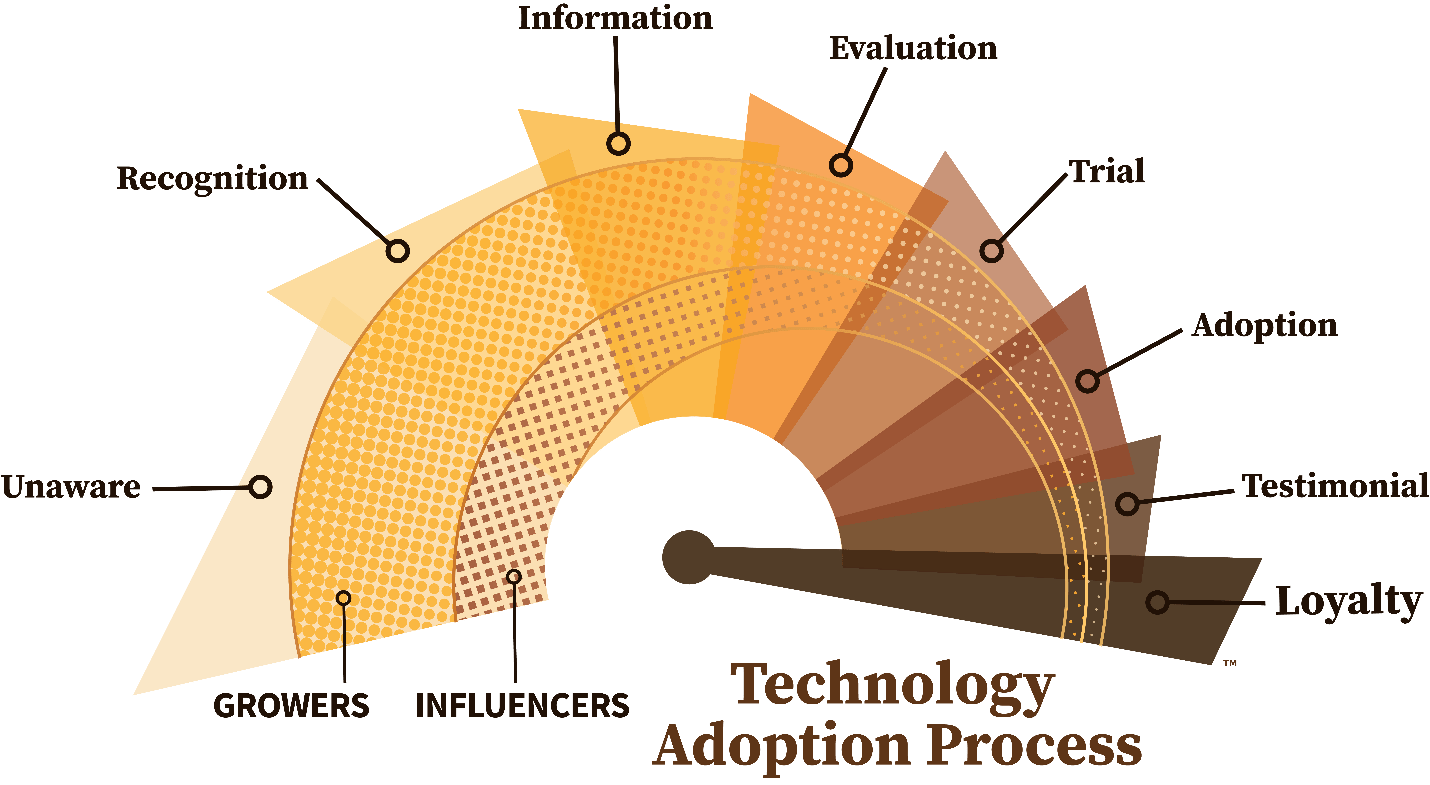

Only the AgiThority® TrialWerx® technology transfer process transforms temporal and spatial data from large-scale, on-farm trials into performance proof. These valuable, actionable insights from TrialWerx® help generate a solid performance story, define value, and position the products for adoption and use. Then awareness, education, personal evaluation and local trialing moves growers and their key influencers toward adoption, belief in the product and long-term use.