Conventional agricultural chemistries have been increasingly scrutinized in recent years with concerns for environmental impact, health impact, public perception and sustainability. Agricultural companies are continuing to look for biocontrol alternatives to supplement their pesticide offerings. While the expected growth of conventional chemistries from 2018-2023 is expected to be only 3.2%, the growth of biologicals is expected to be 13.7% or USD 24.6 billion by 2027, according to MarketsandMarkets.

At AgriThority®, we’ve seen increasing interest in bionematicides, a segment with great potential in the industry. From 2016 -2021 market research reports bionematicides were the smallest market segment within the global ag biologicals, but with the highest expected CAGR (2017-2023) at 17%.

Gaining access to this growing market begins with proven performance with many development steps from registration through field trials, proper placement and formulation to education of the target growers.

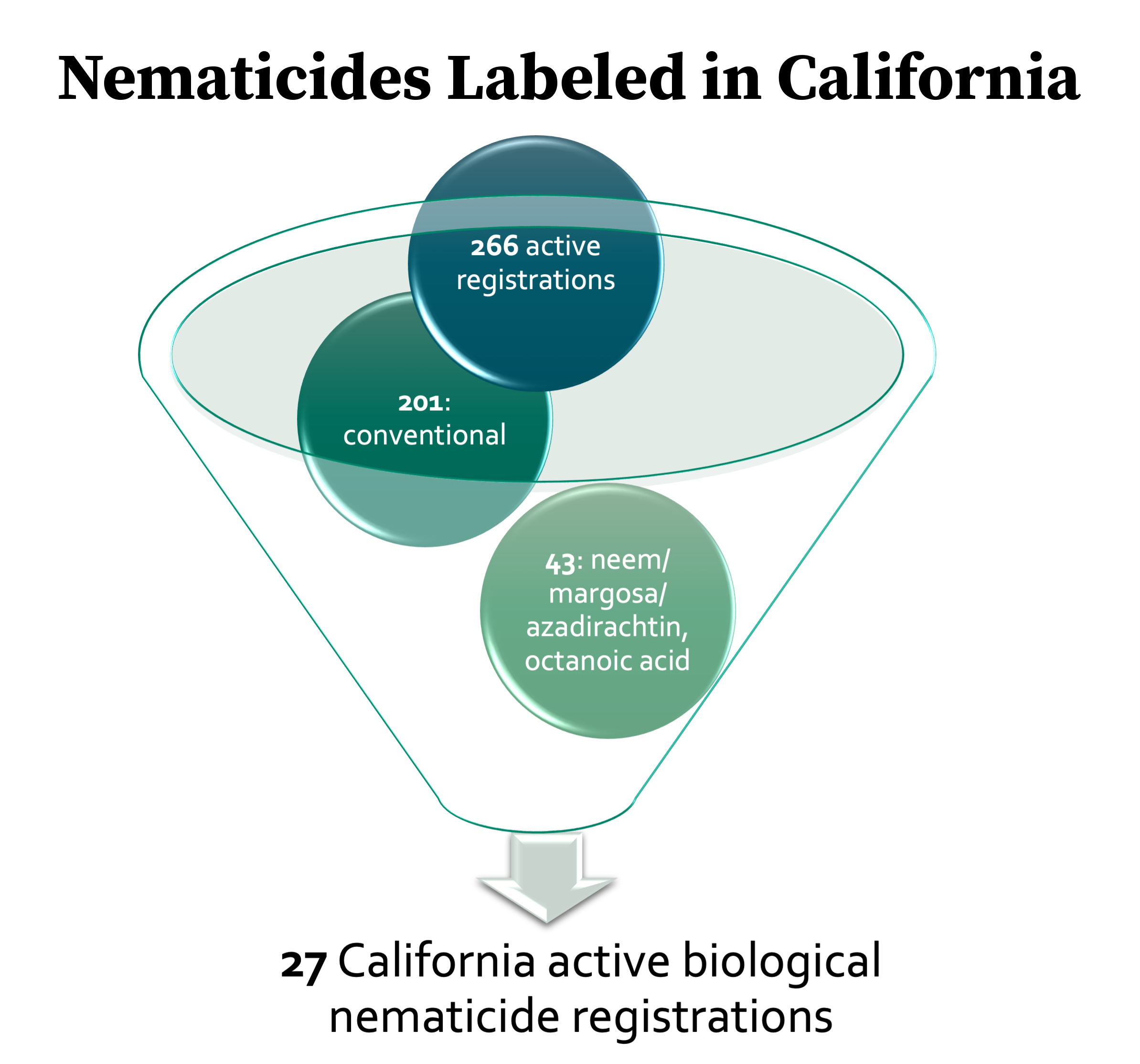

For companies targeting the fresh produce markets, California is the leader, but also is known as one of the strictest states for product registration. Despite the tough regulatory path, 266 nematicide registrations are active in California. Of those, 201 are conventional, 43 are Neem/Margosa/Azadirachtin and octanoic, while 27 are biological nematicides. Eight companies have a total of 27 products already labeled in California as crop protection bionematicides. That represents about 10% of the nematicide registrations in California.

For companies targeting the fresh produce markets, California is the leader, but also is known as one of the strictest states for product registration. Despite the tough regulatory path, 266 nematicide registrations are active in California. Of those, 201 are conventional, 43 are Neem/Margosa/Azadirachtin and octanoic, while 27 are biological nematicides. Eight companies have a total of 27 products already labeled in California as crop protection bionematicides. That represents about 10% of the nematicide registrations in California.

A significant indication of just how much the market is shifting towards biologicals is the nature of more recently registered products and registration requests under review with EPA. There are 12 companies with pending or recently registered nematicides with EPA outside of California. These 12 companies have recently registered 15 new nematicides with EPA, and they have 13 new nematicides pending registration by EPA.

Of the recently registered products, 11 (73%) are bionematicides, and 8 (62%) of the pending registrations are for bionematicides. That means over two-thirds of recently registered nematicides and pending nematicide registrations are biologicals. That’s a trend that’s difficult to deny.

AgriThority delivers key insights on data to help clients better understand their products, determine where their products will best perform, evaluate the competition, and ultimately enter the market. No matter how revolutionary a product seems, the barriers to entry may include established chemistries, standard cultural practices, or lack of awareness by the grower. New technologies will have to fit, adapt and often change grower perceptions or practices for successful entry into desired markets.

Reach out to AgriThority today to help move your new innovations to market.