Biostimulants and biocontrols make many commercial claims. An analysis across more than 100 commercial efficacy claims showed a wide range from 1–5% up to 100%. How accurate are these claims? For example, a claim based on a hard-value result can be true but limited to a specific testing situation, thus making its translation onto wider farming environments uncertain. At this time, the credibility of such claims is of critical importance in defining the future of a new input technology – dubious or biased data may generate a domino effect on similar products, thus hurting the commercial advancement of an entire product class.

Credible, robust data is a critical basis for the definition of a product positioning strategy prior to its launch – which are the crops and environments where the product shows higher and more consistent effects? How is this modified by relevant factors such as standard farming practices and application mode? How is the interaction of this product with standard products used in the targeted areas?

What does the data say?

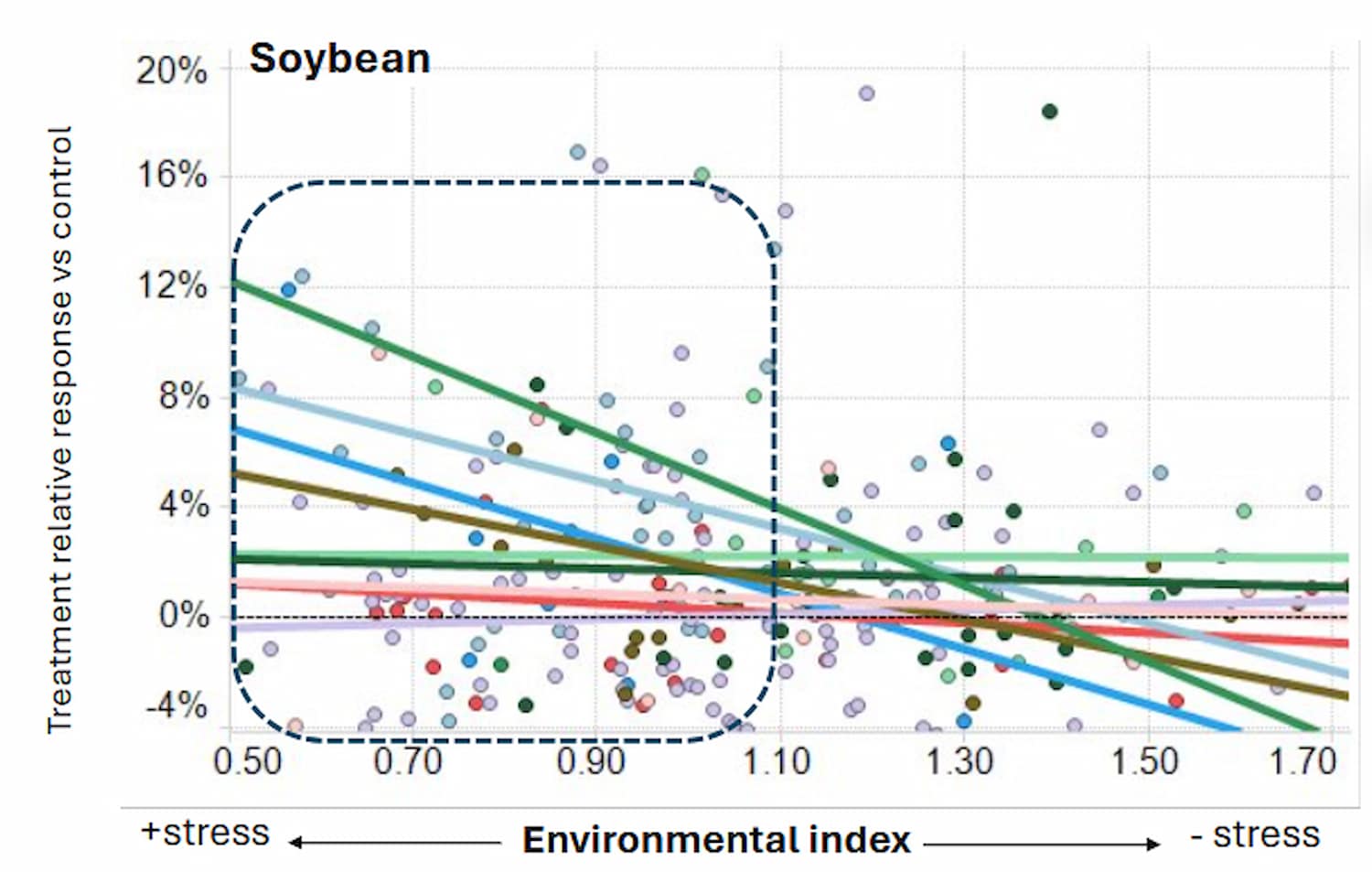

Many times, there’s what someone wishes the data said, what data from isolated trials show, and what data compiled and reviewed as a whole reveals. Balancing the strong value of the big data from trials without disregarding individual farmer experience takes a careful communication strategy beyond the use of hard statistics. Yes, data from someone’s farm is real, but so are the hundreds of datapoints we have collected for similar environments – an effective dynamic merging of both sources helps keep consistent messaging and builds trust. Since 2008, AgriThority® has been doing field trials for more than 530 innovative seed, foliar or soil-applied technologies (63% of those are biologic), on more than 3,500 experimental sites across the world. Based on the historical data, we can now benchmark new innovations based on general patterns we know about their product class. For example for certain classes of biostimulants in soybean in the U.S. and LATAM, we see a significant trend for a higher effect at sites with lower overall productivity, especially associated with low natural fertility and drought. While this needs specific confirmation for individual products, we have a starting point for the design of a development program and positioning for products within this class.

Then there is the benchmarking on mean product effects – looking across AgriThority historical database, horticulture crops in general show a higher response to biostimulants, but experiments in this crop group are consistently noisier than in row crops, which may imply a strong focus on the design of the trialing effort. Of course, cherry-picking trials from specific years of environments will show a different story, but ultimately, it doesn’t matter if one trial shows 35% efficacy if majority of farmers using the product won’t see that. Then it leads to dissatisfaction and more distrust of new innovations.

Is Expected Site Yield the Best Predictor for Positioning Products?

Mean yield around a region is largely what’s been used in positioning products, but this is a sort of black-box environmental indicator, which encompasses multiple factors. Bringing in environmental variables based on soil properties and weather patterns like we do with our StatWerx℠ service is what can make the predictions out of a dataset a lot more meaningful.

Why Is That?

- There is an interpretation for why that could be happening – for example, a product focused on improving crop nutrition may consistently work better in areas with low organic matter and low cation exchange capacity (CEC).

- Once you have an interpretation, it also allows you to model and predict for places in which you do not have trials utilizing reliable long-term data for the region.

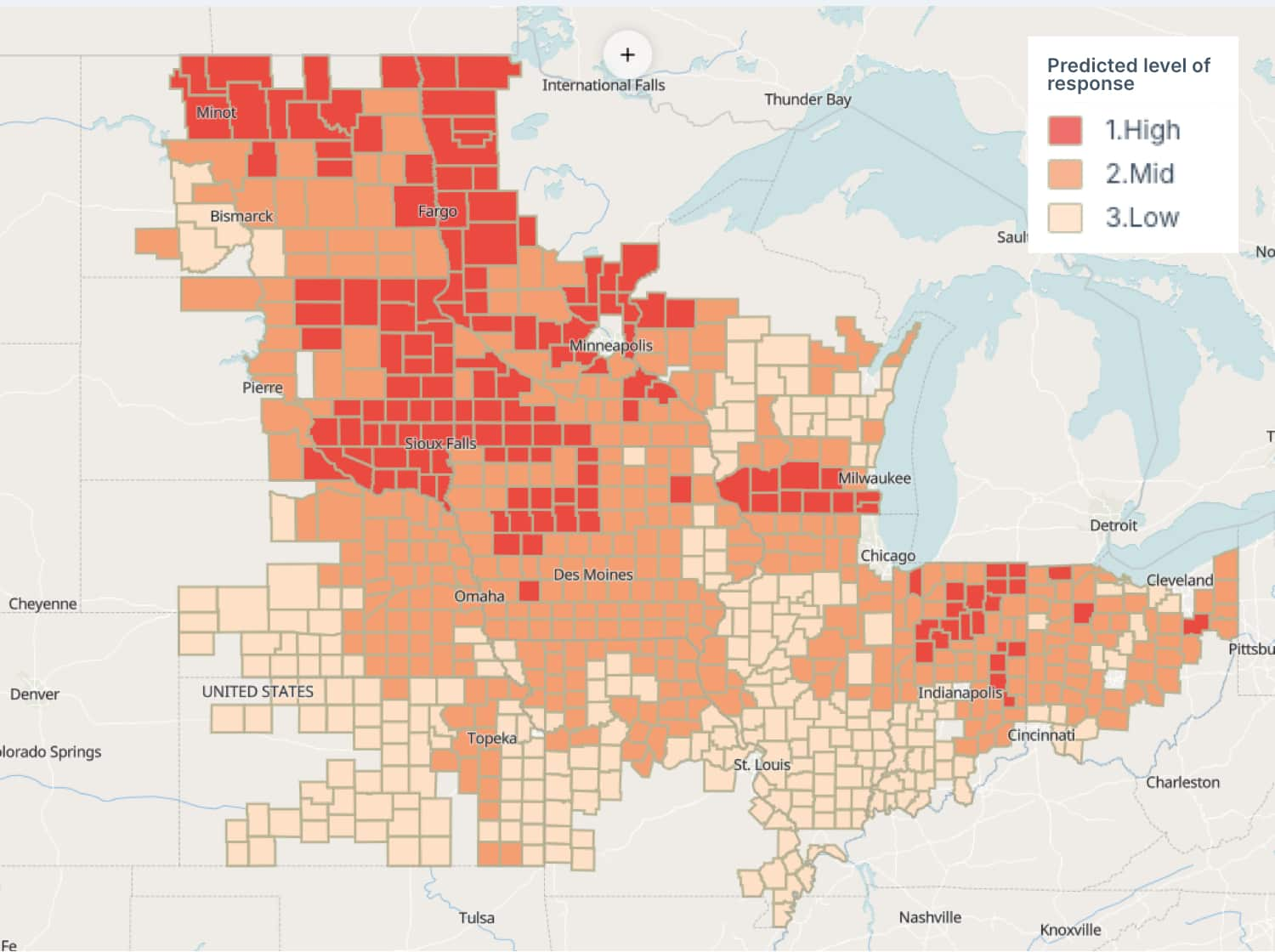

This process allows the marketing team at a company to have an approximation of where their product stands in comparison to others on the market. For example, the map below identifies areas within the U.S. Corn Belt with expected low, mid and high response to a biological input based on a soil-weather model generated from a large network of trials run across multiple years. Visual positioning products generated based on this modeling approach provides a strong tool for aligning communication both within a company, and with clients and allows the estimation of the potential size of the market.

The Objective, Long-Term View

It’s important to take an objective, long-term view when evaluating new products. Credibility is built on data-based, robust claims, leaving out the anecdotal evidence that may not represent frequent occurrence. Benchmarking within a product class can help develop a clearer, objective picture of how a product stands across competitors and what may be a proper positioning strategy for a new biological technology.

At earlier stages of product development, this analytical approach can also help determine the trajectory for the potential product, and whether the company should continue moving forward with development or go in another direction. Everyone wants to speed up the process to generate revenue, but Benjamin Franklin famously said “an ounce of prevention is worth a pound of cure.” Taking the long-term view is the ounce of prevention and could end up making a more successful product for the long term.

When your new biological crop input technology is ready for product development, turn to AgriThority for strategic and scientific expertise. Our global footprint is combined with our deep understanding of agricultural business, regulatory demands, market channels and producer dynamics. We help move your innovation from concept to commercial adoption.

Talk with us at upcoming conferences, email info@agrithority.com, or call +1 (816) 891-0916.