India is the fastest growing economy in the world with a CAGR of 8.3% over the last 3 years. From 2014 to 2023, the Indian economy had grown from the tenth to fifth largest economy. Analysts at Jefferies expect the country to become the world’s third largest economy by 2027, and agriculture is one of the most important industries in the Indian economy. It contributes 16.7% to India’s GDP and employs 70% of the total population. Because of the growing strength in ag innovations, India has the potential to be a major global agriculture player.

Agrochemicals are a major integral part of modern agriculture and are a key driver of crop productivity and food security for a 1.42 billion population. Ranking second after China, India accounts for 11.9 percent of the global agriculture gross value added of US $3,320.4 billion and contributes 12 percent to India’s exports. Long known as the world’s largest producer of milk, jute, and pulses, the global agricultural community is now focused on India’s budding agricultural innovation sector.

Agriculture Innovation Transformation

Indian agtech is poised to add US $95 billion to the economy by 2030. The Indian government supports the growth of this sector with the Digital Agriculture Mission focused on building innovative Agri-focused solutions leveraging digital technologies. The Indian government also recognizes its agrochemical industry as one of its top 12 industries to achieve global leadership growing at 8% to 10% through 2025, according to the Federation of Indian Chambers of Commerce and Industry. The Indian government’s “Make in India” initiative has played a crucial role in supporting the growth of the agrochemical industry enabling the country to become a global hub for the manufacture of agrochemical products.

The India agrochemicals market size reached a value of almost US $7.9 billion in 2023. The market is further expected to grow to US $12.58 billion by 2028 at a CAGR of 9.75% with exports being a key growth driver along with a significant domestic market. Besides formulation and technical, India has an additional opportunity of US $2.5 to 3.0 billion in agrochemicals intermediate chemistries such as Pyridines, Fluorine chemicals, Triazoles, and Benzene derivatives.

These efforts will help the Indian agriculture sector flourish and allow startups to secure increased investments from venture capitalists. Additionally, it will allow for the expansion of global crop exports and foster opportunities for innovations to enter the market.

Investment Opportunities

In 2022, downstream and midstream ag startup funding fell 37% and 65% respectively, investments rose 50% in upstream categories in India, which made them the second-best funded market for agri-food tech startups in 2022, after the U.S. Additionally, agricultural biotechnology funding increased from $1.5 million in 2001 to $123 million in 2022.

Venture capital funding in India has focused on financing and technology to improve practices, as well as mitigating damage from droughts, pests, and flooding. Meanwhile, the rest of the world has funneled more agricultural investments into downstream innovations like food. The untapped potential of India is an attractive option, especially for the next three to five years as innovations take root.

Agrochemical Export Opportunities

India has become the second largest exporter of agrochemicals in the world per the latest data released by World Trade Organization (WTO). The rank was sixth 10 years ago. The USA is the largest buyer of Indian made agrochemicals followed by Brazil and Japan. The high quality, most competitive prices, and judicious use of agrochemicals in the domestic market boosted exports. India uses only 400 g/ha of agrochemicals as compared to the global average of 2.6 kg/ha. The export of agrochemicals reached US $5.5 billion in 2023, up from US $2.6 billion in 2017–18 with a CAGR of 13%. With the government focusing on agrochemicals, it is expected to grow to US $10 billion export by 2026–27.

The key drivers for India’s growth in the agrochemical sector are:

- The backward integration of production processes. Indian companies have been investing in the production of off-patent molecules and reducing their reliance on imports from China. It has helped the agrochemical companies to have better control over the costs and guaranteed and timely supplies. They have been manufacturing molecules of organophosphorus, carbon disulfide, and pyrethroid chemistries and are known worldwide for quality and cost-effectiveness.

- Positive national policies reduced regulatory hurdles and facilitated the upgrade and building of necessary infrastructure with increased production capacities for manufacturing agrochemicals.

- A supportive investment environment. The government and industry have invested profoundly in R&D to innovate newer molecules, manufacturing processes, and green chemistry products and new combinations and solo formulations and products and secure global patents.

- The logistic advantage for fast-track exports. Major manufacturing plants are in the coastal region, giving a distinct advantage in logistics coordination and cost.

- The Indian government is promoting the agrochemical industry aggressively to position itself as a major agrochemical hub.

- Increased awareness among the farmers regarding the benefits of using agrochemicals for crop protection and yield enhancement.

Biological Opportunities

Biological products are gaining attention in India, primarily due to the government’s focus on sustainable agriculture. The need for increased production and the government’s call for sustainable agriculture measures have made farmers begin to recognize this need. While it will take a significant shift in mindset to integrate biological products on farms, many benefits are available with use of biological products.

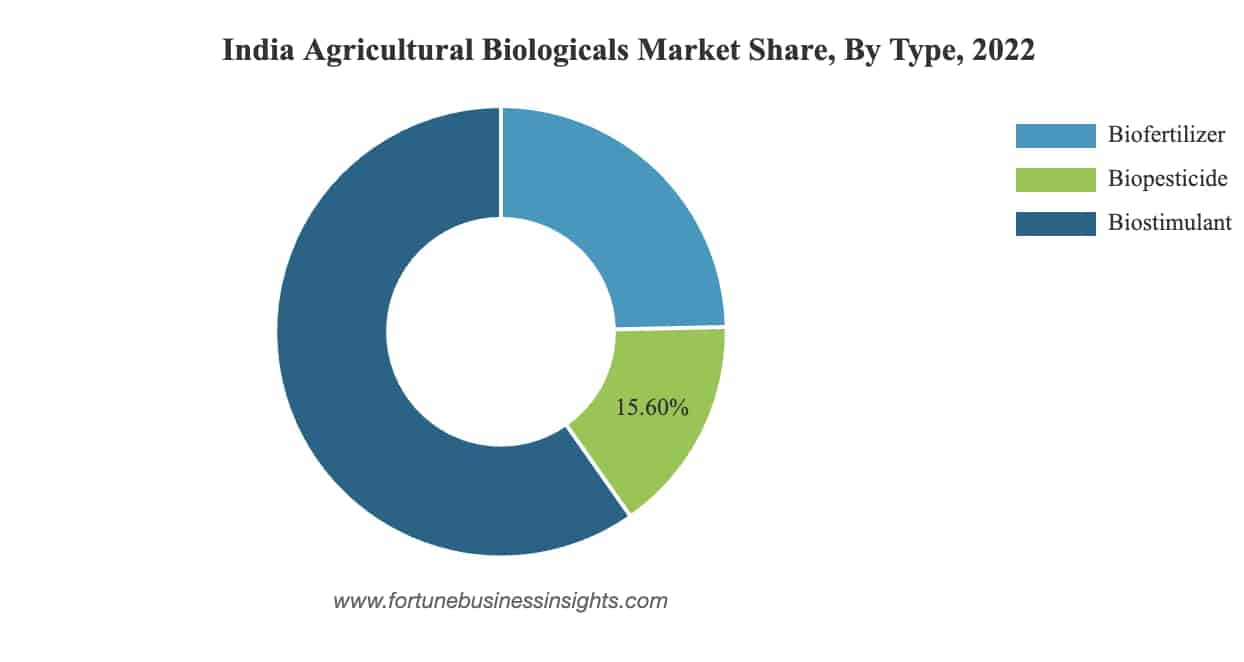

Valued at US $446.26 million in 2022, the India biologicals market is projected to reach US $1,269.24 million by 2030 and exhibit a CAGR of 14.06%. India is asserting itself in the race for biologicals with the rest of the world. A developing opportunity remains in biostimulants and biopesticides as the Indian government continues promoting sustainable agriculture, with biostimulants leading the way.

India is displaying the opportunity to be a major player in agriculture with the growing agrochemical, agtech and biological industries, as well as increasing exports. Investors are taking note and investing in upstream categories and new innovations are emerging into the global market. It is a geography to watch.

When your Research is ready for Development, turn to AgriThority® for strategic and scientific business, market, and product development expertise. As an independent global resource, we focus on exploring potential, expanding market access, and evolving production for greater food security and sustainability. Forward-thinking agriculture experts with deep experience are the core of AgriThority®.