From the once high investment levels the past few years, agritech and innovation funding has dropped to a pre-2018 low. With this evolution, higher production costs and lower commodity prices, competition and consolidation in agriculture is expected to increase. Agritech innovation funding may remain selective, but many opportunities exist for agriculture innovations that are well prepared for successful commercialization.

How much investment is enough?

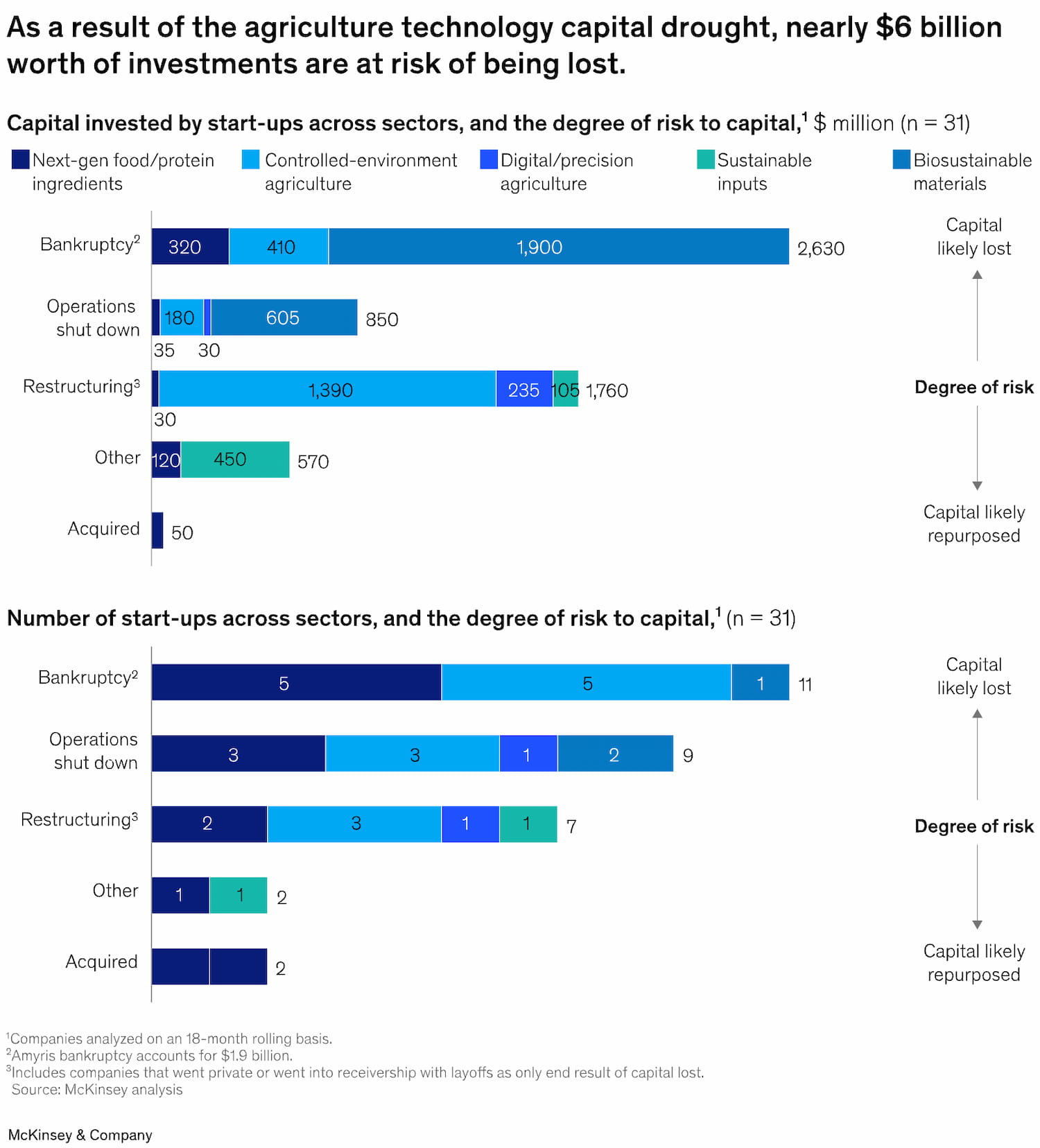

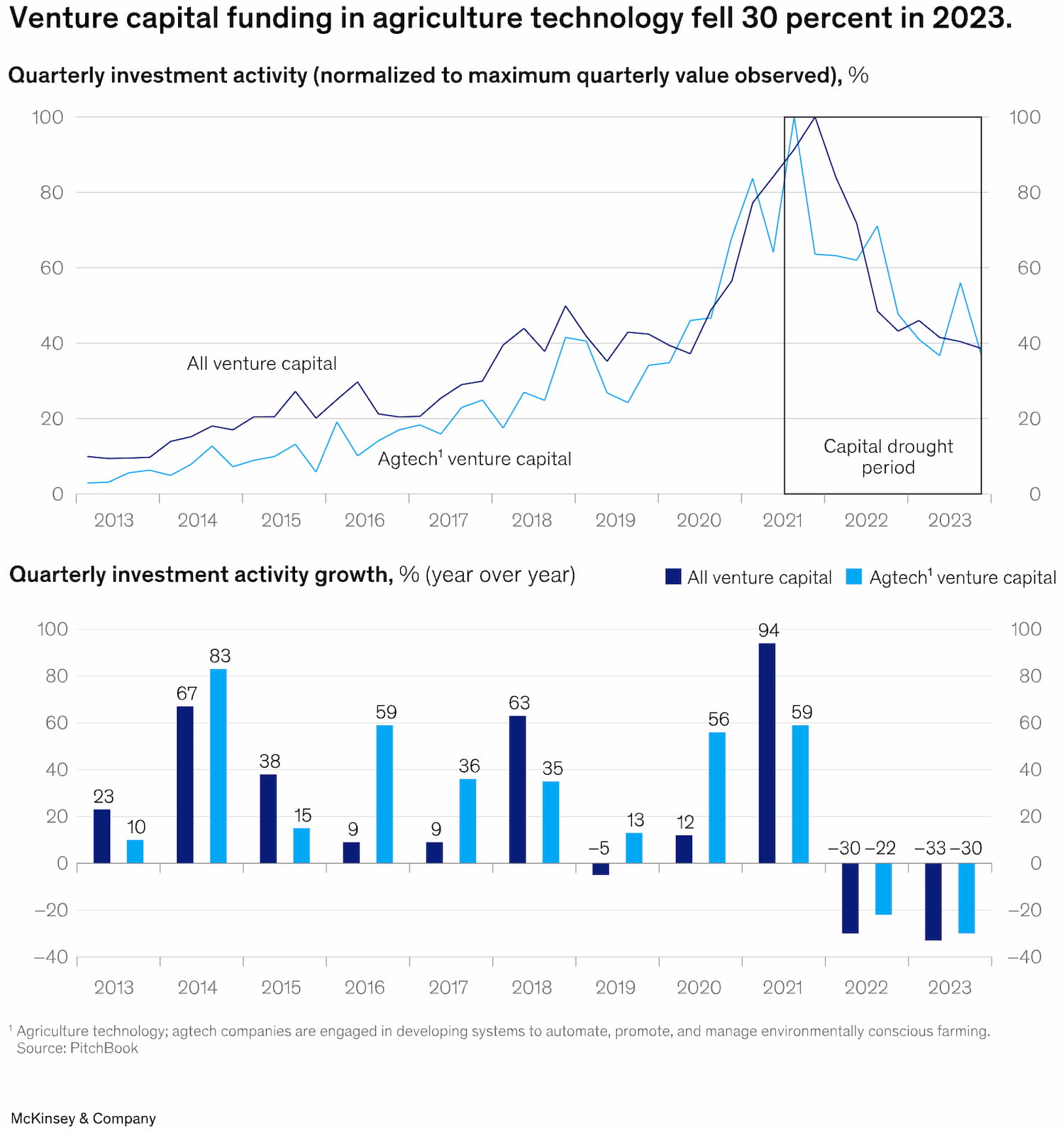

Since the high in late 2021, venture capital (VC) funding has declined 60 percent, according to Pitchbook data. However, many agritechnologies were overvalued and have now level set. In addition, McKinsey estimates nearly $6 billion worth of investments are at risk. Prior to 2021 according to Source Advisors research, 1,773 companies globally received investment funding with 474 headquartered in Europe. This report states globally £186 billion of investment went into these agritech companies from more than 6,000 different investors. The question many ask: “Are we investing enough in agritech to feed the world?”

This same research from Source Advisors determined five key segments in the agritech investment for that period prior to 2021:

- Agri Biotech—this segment led investment in all geographical breakdowns.

- Indoor Farming

- AgriFinance and eCommerce

- Precision AgriTech

- Animal AgriTech

In 2023 the World Economic Forum reported that “data is transforming the agricultural sector…from developing and deploying cutting-edge technology to scaling up solutions. Innovative use cases of data use in four key stages were identified as access to inputs, advisory, finance and markets.”

“Innovation in agritech is growing across the world,” says Amulya Patnaik, Partner, PwC, in the World Economic Forum article above. “We are on the cusp of a 4IR [Fourth Industrial Revolution], especially in agritech. There is immense potential for data and technology adoption that can solve for farmers and businesses at once.”

Investment Opportunities Abound for Agritech and Innovations

Despite the negative headlines, by zooming out and looking over a longer period, agriculture innovation funding is still plentiful. That viewpoint combined with the rapidly advancing technologies in the industry is enough to show opportunities still exist.

“Scale ups that have a clear value proposition, revenue and roadmap to profitability will have less competition,” said John Hartnett, Founder & CEO SVG Ventures THRIVE, during a World AgriTech San Francisco session. He also said corporations will have an opportunity to share and acquire.

A recent McKinsey article says the long-term outlook for investment in the agriculture industry remains promising. The factors that made investment in the industry boom to begin with are still present: food security and sustainability, technology advancements and strong intellectual properties (IPs).

“I’m still optimistic about the future, and we’re continuing to invest in new innovations in agriculture,” said Jim Schultz, Founder and Managing Partner of Open Prairie and AgriThority® Board of Advisor. “The investment ‘tourists’ who came into agriculture thinking it was the new frontier have departed. This left the funders with a focus and understanding of agriculture. Companies must understand who they are aligning with when looking for investment.”

In Latin America, agriculture investments are doing better with biologicals at the center of private equity investment, according to Valdemar Fischer, AgriThority Board of Advisor and former Syngenta executive. “Of the 500 biofertilizer applications in the market, more than half will go away, and the other half need to find a roll-up strategy,” Fischer said. “With 3-5 together, a profitable business becomes more likely.”

Fulcrum Global Capital Venture Associate Bonnie Brayton said, “Today, the startups that stand out during their fundraising are the ones that have gotten creative about their business model and are able to bring in early revenue, or can bring in non-dilutive funding or in-kind collaborations to stretch out their runway. Running a lean operation and finding ways to do more with less is key during times when investment funds are not as readily available.”

Investor Expectations of Agritech and Innovations

Investors have shifted their expectations of agritech and innovations with the changing environment, as well. In the boom years, investors focused on companies with strong growth, but now, they are focused on positive cash flow generation, according to the McKinsey article.

Investing in good quality field trials to validate claims will become even more important to investors in the current market, according to Adrian Percy, executive director of NC Plant Sciences Initiative at NC State University and AgriThority Board of Advisor member. Schultz stressed that companies need to choose a commercial organization that has the expertise to supervise field trials that will generate enough quality data.

“The startups that stand out any time (not just in lean times) are the ones that can leverage strategic collaborations or business development efforts to show market validation for their technology and platform,” Brayton said. “There is nothing that an investor loves to see more than a startup that has a multinational ag business who has invested time and/or resources because they have determined that that startup has something special to offer to agriculture.”

For Fulcrum, Brayton said it’s important to see other strong AgTech investors at the table as co-investors in a syndicate.

“When we invest, we want to invest with others who are focused on a realistic ag exit and concrete farmer ROI rather than solely investing in ideology for a greener future,” she said. “We love a green future, but if a farmer won’t find their 3x+ ROI on a technology, then the chance of adoption and success is limited.”

Although agritech and innovation funding may remain selective in 2024, the opportunities include agriculture innovations that are well prepared for successful commercialization. Reach out to AgriThority® today to discuss opportunities for strategic and scientific business, market, and product development expertise that will help prepare your innovation for investment and for success.