AgTech and biologicals have been stealing the spotlight for investors in recent years, and for good reason. So much potential exists for agriculture to evolve, to adopt new technologies and to renew paradigms to meet the future needs of the global population. Despite a 44 percent decline in 2022, investing in agtech is still a focus for investors.

The decline in agriculture investment can be partly attributed to the overall investing atmosphere. It’s also partly a shift in priorities.

“The Controlled Environment Agriculture (CEA) market was a hot focus the past couple of years, but investors are finding profitability issues in that sector,” says Jim Schultz, founder and partner of Open Prairie and AgriThority® Board of Advisors member. “The ESG idea is aspirational, but it’s not yet been proven as a practical growing method to grow or scale up the localized controlled environments.”

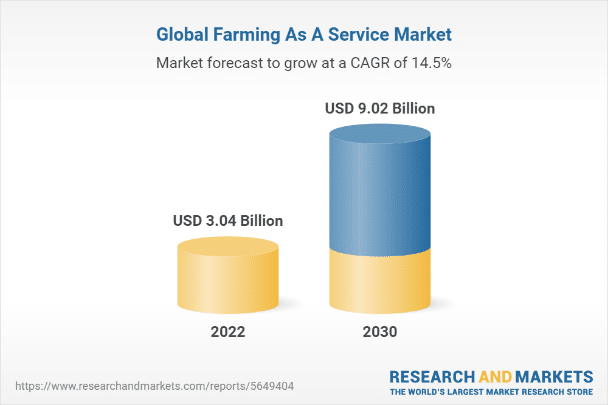

In addition to CEA, vertical farming and cellular meat investments aren’t looking as feasible as they once did, according to Bonnie Brayton, Fulcrum Global Capital Venture Associate. However, labor-saving robotic technologies for crop protection, carrying and harvesting; farming-as a-service technologies and platforms; and biologicals are on the rise.

“The farming-as-a-service technologies and platforms have the potential to reduce capital equipment expenditures and labor costs, which will be greatly beneficial to the farmer,” Brayton says.

According to a Research and Markets report, “the global farming as a service market is projected to reach USD 9.02 billion by 2030. The market is expected to witness a CAGR of 14.5% from 2022 to 2030. Farming as a service refers to using technologies such as machine learning and the internet of things in yield monitoring and collecting weather data. After the collection of data on these metrics, various algorithms are applied on these metrics to gather meaningful insights and analytics. These insights are used to boost the farm’s production and address any shortcomings that can be adjusted to get a higher level of productivity.

According to a Research and Markets report, “the global farming as a service market is projected to reach USD 9.02 billion by 2030. The market is expected to witness a CAGR of 14.5% from 2022 to 2030. Farming as a service refers to using technologies such as machine learning and the internet of things in yield monitoring and collecting weather data. After the collection of data on these metrics, various algorithms are applied on these metrics to gather meaningful insights and analytics. These insights are used to boost the farm’s production and address any shortcomings that can be adjusted to get a higher level of productivity.

Canaccord Genuity Global Capital Markets & Investment Banking estimates the precision agriculture market reached US$9.5B in 2020 and will experience a 12 percent annual growth through 2025. Data analytics, drones, sensors, and autonomous and semi-autonomous farm equipment are opportunities that could reach into the multi-billions.

“The ag investing environment still looks very promising despite an overall reduction in the total dollars currently being invested,” Schultz says. “Agriculture is still intriguing for the non-agricultural based investment firms and venture capital companies, as well as the agriculturally focused funders. We continue to build a strong portfolio of investments that are developing innovative products and technologies that will have a lasting impact on agricultural and rural American economies.”

Biologicals continue to generate excitement among investors and companies alike. Canaccord Genuity Global Capital Markets & Investment Banking anticipates the annual growth rate for the biologicals market to be more than two times conventional crop protection and fertilizer markets.

“Given the anticipation that the biologicals market will continue to grow over 10 percent each year, investments are still being made in the diverse biologicals technologies such as microbial biostimulants and biocontrol, RNAi, PROTACS, antibodies, plant extracts and their brethren,” Brayton says.

Funds are rapidly flowing in from the Cleantech investors, so many AgTech companies are promoting the sustainability of their technologies to unlock deep-pocket dollars.

“In our post-CRISPR world, unlocking genetic diversity through molecular biology is not owned solely by the Big Ag companies,” Brayton says. “There are many startups with unique algorithms competing with mid-sized and larger players to bring novel genes and traits to our tables. Another intriguing trend for the industry as a whole is the increase in supply chain/logistics, traceability and FinTech software-as-a-service (SaaS) in animal production, specialty crops and row crops. As the AgTech startup ecosystem delivers new ways to reduce risks or de-commoditize commodities, that value can be delivered straight to the farm gate.”

These opportunities have the power to help farmers further streamline their operations and manage risk in our changing climate, as well as unlocking value in untapped areas. The potential alone will continue to attract more investment dollars to the industry.

When your Research is ready for Development, turn to AgriThority® for scientific business, market, and product expertise to learn key insights on your new innovations. Our international footprint, combined with our deep understanding of market and producer dynamics, helps you to leap hurdles and overcome barriers to prepare your products for success.