Brazil has been using bioinsumos products in agriculture for decades, with records dating back to the 1960s when they were applied to manage the sugarcane spittlebug and soybean caterpillar. Brazilian companies market bioinsumos as part of an integrated strategy. For example, in Integrated Pest Management with the emphasis is on problem-solving in tropical, high-pressure environments where resistance management is critical.

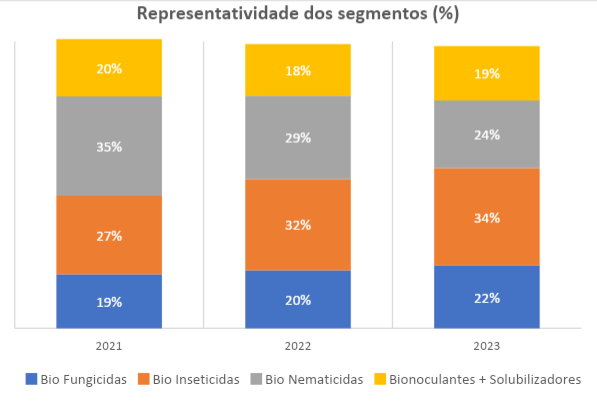

According to CropLife Brasil, the biggest biological segment is bioinsecticides. Among the main crops, of the total use of biological inputs in Brazil, 55% are applied to soybean, 27% to corn, 12% to sugarcane, and 6% to cotton, coffee, citrus, and fruits & vegetables (F&V).

Biological Adoption in Brazil

A good and more recent example to illustrate biological adoption in Brazil is what happened with Helicoverpa armigera, an important pest in soybean crops. The discovery of this pest in Brazil in 2013 quickly showed a high potential to cause severe damage in the fields. With its appearance came a major concern: how could we control it? At that time, there were no registered products available, and little was known about the effectiveness of chemical pesticides against this pest.

The solution for the crops was the use of biological products based on Bacillus thuringiensis (Bt) and virus-based products, such as Nucleopolyhedrovirus (HearNPV), which offered specific and effective action against H. armigera.

The integration of biological and chemical tools can enhance pest control results, increase environmental sustainability, minimize risks to farmers, society, and ecosystems, while protecting soil health and promoting a more balanced agricultural system.

Programs that Include Biologicals

In Brazil, there are several crops that have grower standard practices that include biologicals as well as conventional chemistries to control specific pests with resistance issues:

- Cotton: nematodes and the caterpillar complex, mainly Spodoptera frugiperda and Helicoverpa armigera. Farmers make 15–20 passes each season because of resistance issues, especially in caterpillars.

- Sugarcane: nematodes, and insects such as the root spittlebug (Mahanarva fimbriolata) and the sugarcane borer (Diatraea saccharalis);

- Corn: the corn leafhopper (Dalbulus maidis), responsible for transmitting stunt diseases. These pests are complex to control, so combining conventional and biological is necessary. The fall armyworm – Spodoptera frugiperda is another example, but there are others.

- Soybean: inoculants are used for nematodes, and in addition to nematodes, pests such as the whitefly (Bemisia tabaci) and the fungus causing white mold (Sclerotinia sclerotiorum) are some examples where it’s important to use conventional chemistries and biologicals.

Evaluating Biologicals

When Brazilian farmers are evaluating biologicals, they have certain criteria they use to make decisions.

- Target Pest or Disease Profile: Farmers first identify the main pests, diseases, or nematodes affecting their crop and select biological products proven to be effective against those specific targets. Many biologicals have a narrower spectrum of activity than chemicals, so precision is key.

- Efficacy Data and Field Trial Results: Adoption depends heavily on local field trial results and efficacy data, preferably from independent research institutions or technical consultants. Brazil growers value practical, in-field evidence before trusting new biological products.

- Compatibility with Existing Crop Protection Programs (MIP/IPM): Grower’s check whether the biological can be integrated into their Integrated Pest Management (IPM) strategy, considering application timing, compatibility with chemical pesticides, and resistance management needs.

- Cost-Benefit Evaluation: Though biologicals typically have a lower environmental impact, farmers carefully weigh product cost, application logistics, frequency of use, and expected ROI compared to chemical options.

The biological input companies stress compatibility with chemical pesticides, tank mixes, and application routines. The market often demands biologicals that can be easily integrated into existing operations without extra labor or equipment. Product adoption is heavily driven by demonstration plots, on-farm trials, and peer validation. Growers in Brazil trust what works in their region and crop, and companies often invest heavily in field days and technical visits to showcase performance.

In recent years, the adoption of biological solutions in Brazilian agriculture has expanded significantly, driven by growing awareness of sustainable farming practices. This trend has encouraged both farmers and consumers to seek alternatives that combine profitability with lower environmental impact.

Agricultural biological products recorded sales of R$ 5 billion in the 2023/24 growing season, based on farm gate price.

Learnings for Other Regions

Brazil proves biologicals succeed when they’re practical, proven, and integrated—not just “green alternatives.” Other regions can replicate this by focusing on farmer-centric solutions, local validation, and systemic compatibility. Some additional insights for other regions:

- Biologicals thrive as complements, not replacements, for conventional chemistries

- Farmers won’t adopt solutions that disrupt their routines

- Growers trust what they see working on their land

- Biologicals must perform under intensive pest/disease pressure

- Regulation and research accelerate market growth

- Farmers need confidence to switch practices

When your Research is ready for Development, turn to AgriThority® for strategic and scientific business, market, and product development, as well as regulatory expertise. As an independent global resource, we focus on exploring potential, expanding market access, and evolving production for greater food security and sustainability. Forward-thinking agriculture experts with deep experience are the core of AgriThority®.