Biological products are increasingly used by growers around the globe to control pests and to increase crop productivity. The demand for sustainable, environmentally friendly production methods has increased the rate of adoption of biologicals in the past 10 years. Understanding the history of biologicals, the evolution of the biological market, and on-farm adoption challenges are critical for biologicals to become mainstream for farmers.

The 2024 Salinas Biological Summit examined the impact of the call for “less chemicals and more biologicals” on growers and the emerging technologies and biological solutions being developed to support them. Throughout the conference, three key topics continued to be discussed.

Defining the Biological Landscape

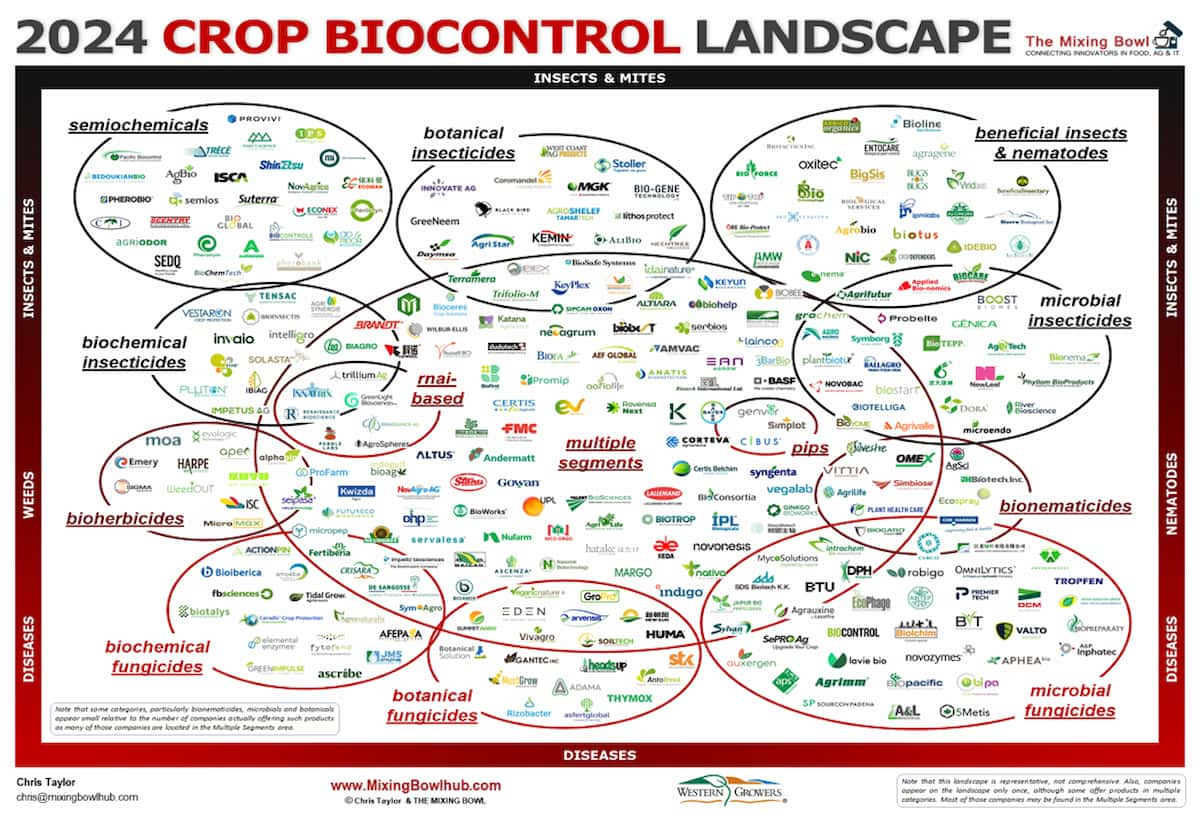

Fueled by the desire to capture the crop biologicals space and players, The Mixing Bowl created the Ag Biologicals Landscape, which was debuted at Salinas Biologicals Summit in June 2023. The landscape captured roughly 400 companies represented in eight segments within the biological control, crop health and soil health space. However, due to the number of companies in the biological space, it proved challenging to capture all the products in one graphic.

As such, it was imperative to further define what “biologicals” truly means, so the research team cut the landscape in half in their 2024 Landscape.

- Crop BioControl (aka BioProtection, BioPesticides)

- Crop BioProductivity (BioStimulants and BioNutrition)

Crop BioControls

The integration of Crop BioControls in production systems reduces the synthetic chemical load on the environment. In doing so, those synthetic chemical products also can be preserved for future use where and when they are needed.

The division of the 2023 landscape identified 300 companies delivering biological crop protection products for controlling insects and mites, diseases, weeds and nematode pests.

It also allowed for better organization and segmentation. The landscape was organized by target pest: insects & mites, diseases, nematodes and weeds, and further segmented by technology (active ingredient category or control type). Segments include:

- Insects & Mites

- Diseases

- Nematodes

- Various Target Pests / RnAi

There are many startups emerging in the biological space, but they ultimately must out-perform and displace products already in the market. To gain traction in the crowded space, new technology-based products must be differentiated and supported by novel formulations, value-added bundles, with scalable manufacturing and competitive COGS/pricing. Most importantly, it is critical the manufacturers understand and communicate how a new product will fit into widely accepted crop production systems. This must be supported by demonstrating the value and ROI of biological products to gain adoption.

Ag Biologicals Investments

The same factors that can lead to biological adoption on farm also can lead to increased investments and funding for startups. The need for differentiated technology paired with a thorough understanding of where your product works and demonstrated ROI is crucial. The technology must be field tested under grower conditions and scalable commercial proof of concept must be provided. Just as a high value proposition will be meaningful to growers, a solid integration plan must be presented to potential investors.

On a similar note, investors looking to fund biological technologies need to be aware of these factors when evaluating investment opportunities in the biological space. It is often easy to get excited by a technology proposition. It’s important to ensure the new technology or product solves a real problem in a given crop; but, even more importantly, it’s critical the market is large enough to warrant the investment. Success of a new product is directly correlated to a strong development plan and field testing; and it needs to be executed with regulatory framework in mind. Finally, it is important for investors to work with trusted partners in the ag space to determine the best opportunities for biological investments.

The agricultural biologicals market is valued at US$12.9B and is projected to reach US$24.6 billion by 2027. With the expanding number of new biological products entering the market, it is also imperative for both innovators and investors to have a thorough understanding of the marketplace landscape and the resolve to cost-effectively address grower needs.

When your Discovery Research is ready for Product Scoping and Development, turn to AgriThority® for strategic and scientific business, market, and product development expertise. As an independent global resource, we focus on exploring potential, expanding market access, and evolving production for greater food security and sustainability. Forward-thinking agriculture experts with deep experience are the core of AgriThority®.