Nitrogen is arguably the most fundamental input in crop production. That is why nitrogen management is a key topic of interest for growers. Challenges in price and availability of nitrogen fertilizers are always points of concern. But the growing awareness of the environmental impact of fertilizer applications, especially nutrient runoff, is driving an increased regulatory burden. These factors have fueled the interest in potential alternatives, especially nitrogen-fixing and nitrogen-efficiency microbial solutions.

But this interest is not uniformly translated into widespread utilization. While in Latin America, especially Brazil, the utilization of such solutions is totally embedded into production practices. In North America, growers remain reluctant to replace chemical fertilization with biological alternatives.

What lessons can be learned from the experience in South America that could be leveraged to drive adoption of biological alternatives elsewhere? The most successful example of full-scale biofertilization is that of soybeans in Brazil.

“In Brazil, the practice of employing biological nitrogen fixation in soybean cultivation is widely adopted, with nearly all of Brazil’s soybean nitrogen needs being met through biological fixation processes,” says Artur Soares, Director of Science and Development at Simbiose, a major company provider of biological products in Brazil. “This technology has firmly established itself as an integral part of soybean production in the country. Over recent years, there has been a remarkable surge in the adoption of nitrogen-fixing products, reaching virtually 100% of growers. This surge can be attributed to the concerted efforts of organizations like Embrapa and various inoculant companies, who have conducted extensive research and launched impactful marketing campaigns.”

The Brazilian Agricultural Research Corporation (Embrapa) was established by the country’s federal government in 1973 to develop the technological foundation for a genuinely tropical model of agriculture and animal farming. The biological inputs project searches for sustainable technologies with less synthetic inputs and more economic value. It was part of a strategic effort to make Brazilian food production more resilient and less dependent on imported inputs. Driven by credit incentives, practices like inoculation and no-till were recognized as more sustainable. It became not only profitable, but fashionable in the minds of farmers.

The case for using N-fixing biological products on soybeans may seem obvious because legumes have a symbiotic relationship with vital nitrogen-fixing bacteria. This early success influenced farmers to be more open to other product categories. The development of innovative technologies based on free living bacteria able to independently fix nitrogen is promoting the expansion of Nitrogen fixing inoculation to other crops, especially corn.

Additionally, use of other microorganisms aimed to improve the availability and use efficiency of other nutrients, such as phosphorus and potassium, is increasing. That is driving the practice of “co-inoculation” (multiple bacteria) and consistent market growth. Driven by Brazil, the Latin America biofertilizers market is expected to reach $408.6 million by 2030 at a CAGR of 12 percent, according to a Meticulous Research report. In Biostimulants, farmer adoption of biologicals in South America outpaces those of North America and Europe significantly, with 50% of farmers utilizing a biostimulant, against only 16% in the USA and 28% in Europe (Global Farmer Insights report by McKinsey and Company). Finally, biocontrols utilization is also on the rise. “In Brazil, the adoption of biological products is on an irreversible upward trajectory,” Soares says. “Over the past decade, adoption has witnessed a substantial increase, and this trend is set to continue. Globally, there is a growing demand for environmentally friendly products that can sustain food production while minimizing harm to the ecosystem. Moreover, chemical products are losing their effectiveness rapidly, creating an opportunity for biological control to step in and enhance management practices for improved productivity,” says Soares.

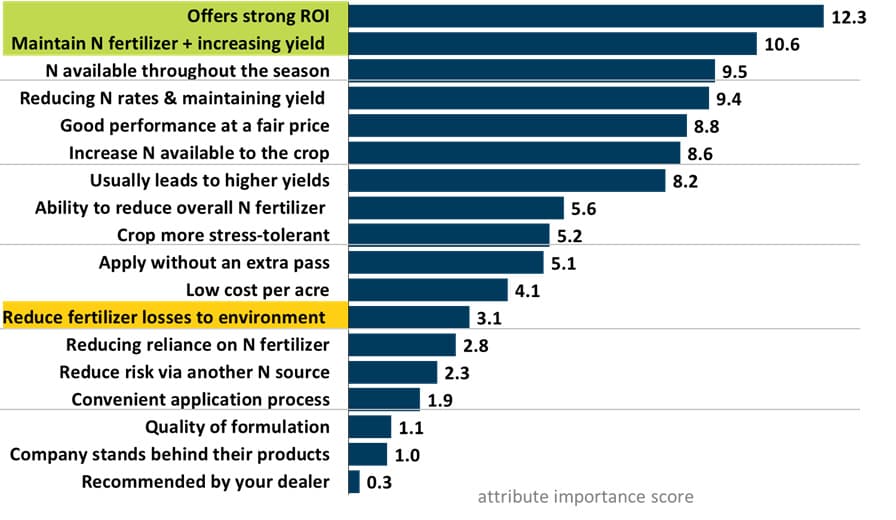

When looking at the USA, the story is different. According to a Stratus Ag Research survey with North American growers: “The N-fixing category has the most traction but the lowest satisfaction, with almost 20% of users disappointed. There could be a few reasons for these differing levels of satisfaction. While N-fixing biologicals are getting a lot of attention and becoming one of the biggest biostimulant categories, it also means that many of the users are new to biostimulants and are still learning how to get the best results. But the dissatisfaction is also likely related to the high expectations growers have for products associated with nitrogen; many growers associate nitrogen very directly to higher yields.”

Gloverson Moro, Ph.D., AgriThority® Chief Technology Officer agrees, “Adoption of biological products can sometimes be a hard sell to successful farmers because it requires them to reduce applications of products they have used and that they believe increases yield. It is a change of paradigm. Incentives should be created to support that transition. I see the development of the carbon credit market, associated with reduced chemical fertilizer use and replacement for microbial options, as one of such mechanisms. The farmer would learn that his yield would not be affected, and he could get additional revenue from that practice.”

Biological N-fixing products are a potential solution to reducing N application rates and maximizing the efficiency of what is applied. But more extensive trials that indicate where products work best, more grower education and establishing Best Management Practices (BMPs) are essential to seeing N-fixing biological products becoming more widely adopted in the U.S.

AgriThority® has worked with more than 238 biologic technologies over the years. With internationally recognized leaders connected to more than 400 local specialists in a worldwide network, we bring deep experience testing more than 670 technologies across 3700+ field trial locations for 250+ multi-national, mid-size, and start-up companies.

When your Research is ready for Development, turn to AgriThority® for scientific business, market and product development expertise. As an independent global science resource, we focus on exploring potential, expanding market access, and evolving production for greater food security and sustainability. Forward-thinking agriculture experts with deep scientific experience are the core of AgriThority®. With boots on the ground—and in the fields, trust AgriThority® to listen, lead and deliver.